18/03/2016

Strategy of the day: Track the trend (part 1 of 4)

T3B taught us to track uptrending stocks and also advised

us that 1 year high is the key criteria.

However, how do we track if market overall has been down

below 1 year?

William O’Neil said:

·

If you buy during a market uptrend, you have

75% chance of being right

·

If you buy during a market downtrend, you have

75% chance of being wrong

Let’s say you like to choose trades from mid cap, so you

follow FBM70:-

Example (1) say e.g from Jul 2014 to Jun 2015 (blue box).

In this time frame of 1 year, the market is down (shown by brown line).

Example (2) the whole of 2015 was side trend (orange box

shows 1 year of 2015) shown by blue line sideways. But the year was volatile

and had big up to down swings.

Example (3) the current time frame, from Feb 2015 to today

is technically a downtrend (gold line shows a downwards).

So how do we trade if the market is not in an uptrend at

all if under T3B rules?

The first rule of T3B criteria for S1 is uptrend follow by

break high.

No 1 year uptrend, no break high, how?

|

track the trend (part 2 of 4)

Here is the table from T3B black book that says a 1 year

high is the criteria.

However, when an uptrend is finished (begins downtrend) I

shall assume a fresh start. So I shall take the first 3 month high as a birth

of a new uptrend. Then, I can start to trade again.

Not to confuse with S3 (which is taking a new position when

S1 pullback), start of a new S1 can be as following chart.

The chart is the

index of 70 mid cap stocks, So if the market of mid cap represented by this

index chart is on uptrend again, then there will be many stocks we can trade.

The green circles show the signals of 3 month high and

beyond. Notice that the blue line and also the gold line are uptrend patterns.

15/03/2016

Strategy of the day: Engulfing reversal

Look at this chart. There were heavy volumes at $87-$90

range during mid Feb. Notice the engulfing candlestick pattern a day after

the high volume bar? Such reversal is usually very strong and follow up is

important.

The first reversal (2nd black line) failed even

with higher low.

Then engulfing with high volume came in follow by gap up

(green circle)

This is a signal to buy.

|

14/03/2016

Strategy of the day: plan your trade

Planning your trade is supposed to minimize risk in the

event that your decision is incorrect.

Ask yourself:-

1.

Did I buy by chart signal or someone or

something told me?

2.

Did I check the profit:risk ratio?

3.

Is this stock still fundamentally strong?

4.

Was this stock at bullish reversal?

5.

Did I check the support, the cut loss stop

price?

Learning is a continual experience but worse of all is not

to experience any loss. The hard truth a trader gets is to experience the

first bitter lesson of heavy loss but you must stand up, face it and say to

yourself never to be so foolish again.

There is only one time loss, the day market is against

your decision but if you can breakeven, don’t let it lose a single penny.

|

Strategy of the day: to track formation of a cup pattern

(part 3 of 3).

As explained in part 2, the big volume push towards end

Oct were smart money accumulating for more upside. The stock finally hit back

1 year high, and formed a big cup with handle at end of Dec.

Volume increase during running up is big boys buying and

if any short pull back is just shaking off weak holders (see the dotted box)

|

9/03/2016

Strategy of the day: to track formation of a cup pattern

(part 2 of 3).

Usually after a long downtrend, a fundamentally good stock

will bounce back.

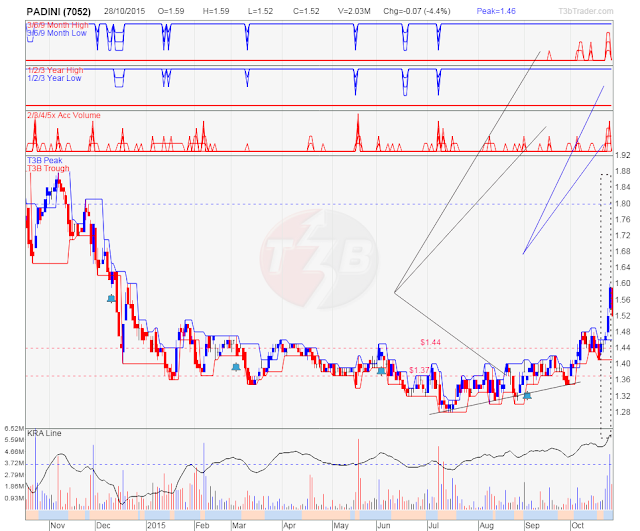

In Padini chart below, the selling in June and July are over

(panic selling, accumulated by big boys in August to September and now major

push – see the huge volume drawn in blue lines). The stock break major

resistance and now exponentially up. The size of the cup form is now extended

from 6 months to 9 months.

The next phase could be either extending the cup or a

pullback to form the handle.

8/03/2016

Strategy of the day: to track formation of a cup pattern

(part 1 of 3).

We all learned that cup is a powerful consolidation pattern

with strong support. There are higher lows to show us that the chart has bottom

out.

In the example below, we see that the last support is now

a broken resistance ($1.37).

Tell tale signals:-

1.

Chart break high

2.

Higher volume on breakout

3.

Troughs are getting higher (line drawn joining

the bottoms)

The next test will be breaking the next higher resistance

($1.44)

And form a round bottom, the cup.

|

Strategy of the day: uptrend weaken, trend reversal

signals

Uptrend will never be up forever. Notice tell tale signs:-

1.

Making lower peaks, highs going downwards

2.

Falling down wedge pattern

3.

Multiple

tops (like in sample chart below), hitting top resistance

4.

Possible formation of head and shoulders

pattern

5.

Candlestick reversals like evening star,

shooting star, bear engulfing, bear harami

As such, once you can identify them , it is time to stop

holding and plan exit strategy

|

4/03/2016

Strategy of the day: consistent strong uptrend.

Not easy to find such uptrending stocks but if you can see

one like that, there is virtually no trend reversal signal. Both peaks and

troughs are straight up.

For such good uptrending stocks, you can enter whenever it

retraces and then wait for sell signals like reversal patterns, etc.

|

3/03/2016

Strategy of the day: exponential uptrend reversal

The chart of DIS below shows an exponential uptrend with

higher highs and much higher lows.

Step (1) = draw a blue line joining all the tops, touching

as many peaks as possible. You can draw another one at the higher part of the

chart (the exponential trend area)

Step (2) = draw another coloured (purple) line joining all

troughs (lower portion of the price bars).

Step (3) = if it is an exponential chart, you can draw

another black line joining all the new lows at the higher portion (the

exponential trend area)

Can you notice when price suddenly dropped to below the

extended purple lower line? Also notice the high volume. That’s buying at

climax and end of uptrend.

Such exponential uptrend may be due excessive speculation

that cannot be sustained and subsequently followed by huge fall in prices.

|

29/02/2016

Strategy of the day: Buy on pullbacks

After a correction, wait for break out of resistance and

then buy (red circle). Just like T3B classic S3, wait for cross over DTL

(down trend line) and buy on BP (break peak). The key problem with us is

watching and patience. Those who think of winning and those lack of patience

may fail.

|

26/02/2016

Strategy of the day: A 10-minute break

In the evening, after market closed, do these steps:-

1)

Check the broader market – read the main index

chart – determine trend, strong or weak up trend? Remember, NO UPTREND, NO

BUY.

2)

Check your stocks in trade – look for trend

reversal signs – adjust your sell stops if necessary.

3)

Hunting fresh stocks for your watchlist? Hei!

You have done your 10-minute already and if you can, you may start hunting.

REMEMBER, it may take >half hour to do

hunting, so do this once or twice a week.

|

25/02/2016

Strategy of the day: When candlestick reversal pattern

seen, when another sell signal also appear later, then to sell or to hold

will be your final decision. Seriously, you need to read your trade in chart

daily. Do as the chart says, no regret. Don't bother the news, the most

respectable analyst's or even your mentor's stories. Charts cannot bluff.

|

24/02/2016

Strategy of the day: RESPECT THE LONG DOWN BAR! That this

stock has good fundamental, that it is strong, consistent up trend, when it

got to crash, it crashes. Nothing is permanent. Sell when the chart says so!

|

23/02/2016

Strategy of the day: if the broader market uptrend ends, we stop buying and start selling. If nothing to sell, we have a drink.

LL (lower lows) signal sideways, distribution on the way down

|

22/02/2016

Strategy for the day: ALWAYS HAVE EXIT STRATEGY

BEFORE YOU BUY. Buying is like a commando going into a building to fight

terrorists, must know when to escape and watch from outside otherwise you will

be slaughtered inside.Always set your exit rules before you click buy ......

SAIL will invest over Rs10,200 crore on mine development as the domestic steel giant embarks on a modernisation and expansion programme.

ReplyDeletefree intraday tips

Thank you for the read. Honestly you covered the topic and broadly examined all areas. If i was to write this i would have done a few things differently myself but you have definitely inspired me to get into the world of blogging. Thanks heaps for the post i really appreciate it. Have a good day and keep blogging essay writing serivce

ReplyDeleteWelcome!

DeleteContinue to visit ya..

This website was.how do you say it.Relevant.Finally I've found something that helped me. Appreciate it!

ReplyDeletecasio